Real Estate Client and Property Matching

In the competitive world of real estate, efficiently onboarding clients and pairing them with suitable properties is essential. This involves a deep understanding of client preferences, budgets, and unique specifications. By harnessing FlowOn, real estate agencies can systematically capture, validate, and analyze client information to enhance property-client matching.

What We Will Do:

1. Building A Client Directory Using the Contact Entity

- Gather Client's Details: Name, email, phone number, current residential status (renting, owner, looking for investment), preferred property type (condo, house, townhouse), number of bedrooms, budget, preferred location.

- All information provided needs to be cross-checked for accuracy to ensure optimal property matches.

2. Client Data Validation

Validation Process: Ensure the data's reliability and precision.

- Ensure emails are in a standard format (e.g., name@domain.com).

- Confirm phone numbers adhere to the expected length and acceptable prefixes.

- Ensure the budget is numerical and aligns with realistic market expectations.

3. Property Matching Algorithm

Data Gathering: Use the validated client data to extract key preferences.

Calculation Process: Implement a decision table to shortlist properties in line with client preferences.

| Preferred Property | Budget | Location Preference | Match Score |

|---|---|---|---|

| Condo | >= $250k | Downtown | A |

| House | >= $450k | Suburbs | B |

| Townhouse | >= $150k | Near Schools | C |

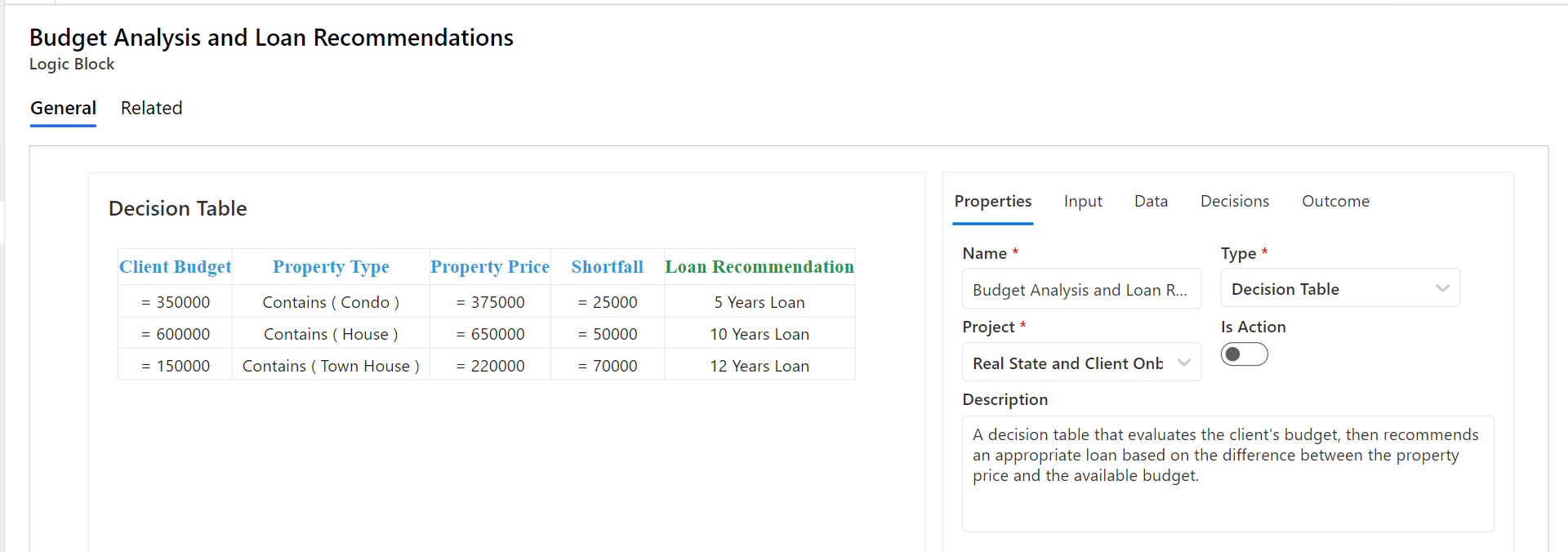

4. Budget Analysis and Loan Recommendations

Data Gathering: Relate the client's budget with potential property options.

Recommendation Process: If a desired property slightly surpasses their budget, suggest relevant loan or mortgage solutions.

| Client Budget | Matched Property Type | Property Price | Shortfall | Loan Recommendation |

|---|---|---|---|---|

| $350k | Condo | $375k | $25k | 5-year term |

| $600k | House | $650k | $50k | 10-year term |

| $150k | Townhouse | $220k | $70k | 12-year term |

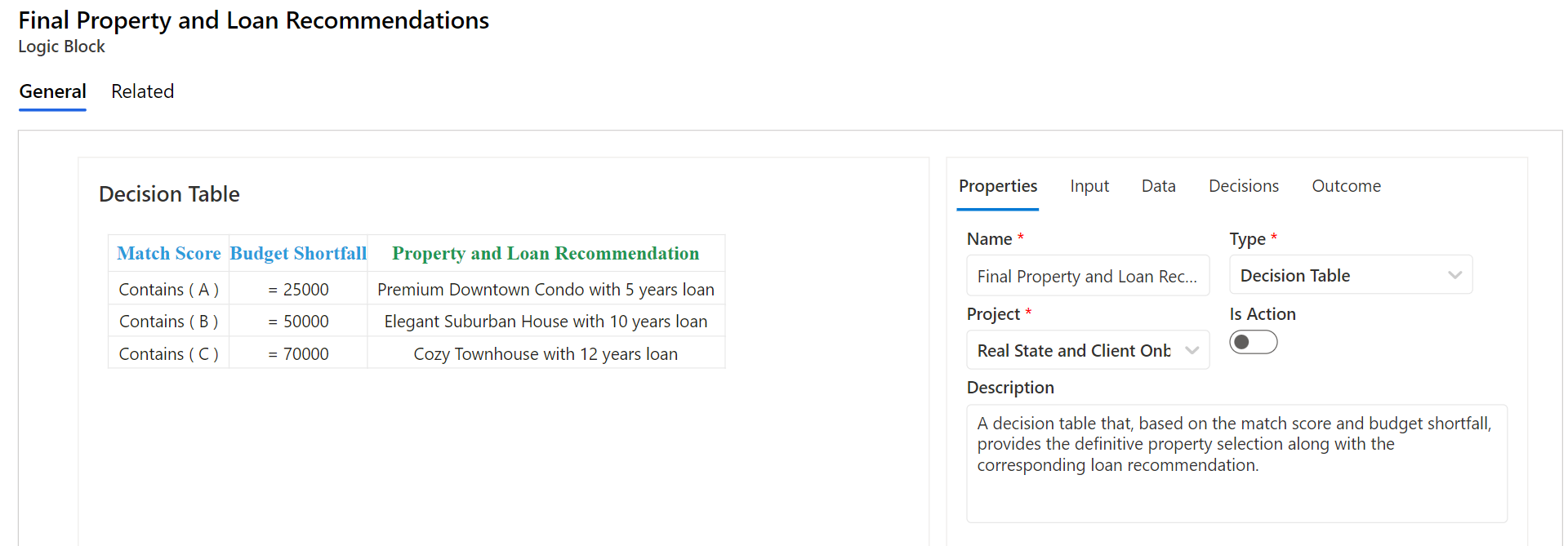

5. Decision Table for Final Property and Loan Recommendations

As we wrap up the client onboarding process, we integrate the insights from our earlier evaluations to present precise property and loan recommendations. Combining the client's match score (derived from their property preferences) with any budget shortfall helps us pinpoint the perfect property, and when necessary, recommend an appropriate loan option.

| Match Score | Budget Shortfall | Property Recommendation | Loan Recommendation |

|---|---|---|---|

| A | $25k | Premium Downtown Condo | 5-year term |

| B | $50k | Elegant Suburban House | 10-year term |

| C | $70k | Cozy Townhouse | 12-year term |

Solution

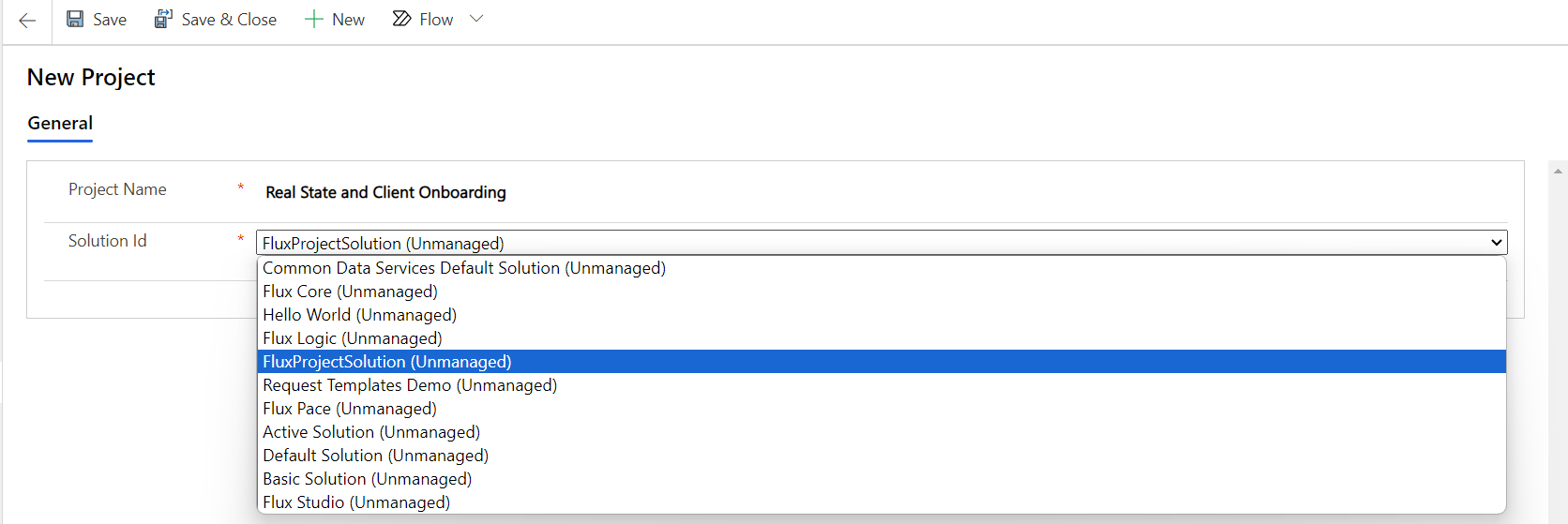

Step 1: Creating the real estate FlowOn project

Initiating our journey, we embark on establishing the "Real Estate FlowOn Project" by specifying its name and the solution id to which it belongs. This foundational step will serve as the hub for all our tailored customizations. Within this project, we'll house crucial components such as the logic blocks, flows, and recipes. By centralizing these elements, we ensure streamlined integration and efficient execution as we progress in our real estate endeavors.

Once the project is created, it will appear in the active flowOn projects list, displaying its solution name, type, prefix, and unique solution identifier.

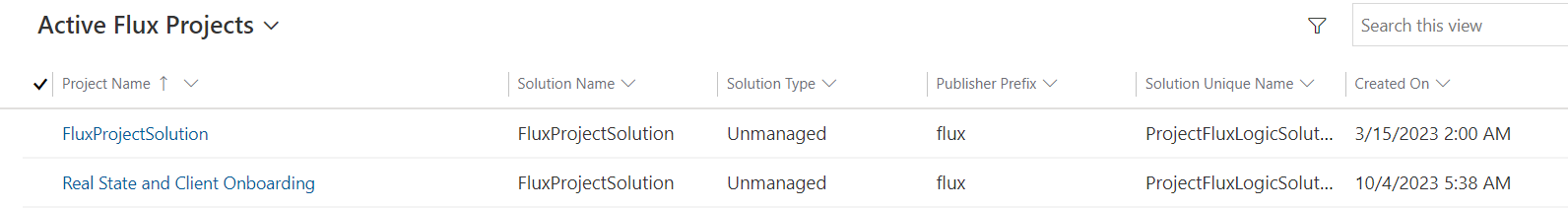

Step 2: Creating a Validation Set to validate the real estate client details.

To initiate our solution, we will be designing a Validation Set. That accept the insurance informations as input.

- Client's Details: Name, email, phone number, current residential status (renting, owner, looking for investment), preferred property type (condo, house, townhouse), number of bedrooms, budget, preferred location.

Each of these inputs is equipped with its own validation block to ensure accuracy and correct format, as shown in the picture below.

And the validation set return an error upon encountering the first inconsistency or inaccuracy. This is to ensure immediate feedback for rectification. With our Validation Set in place, it guarantees that all subsequent steps in the evaluation rely on verified and dependable data.

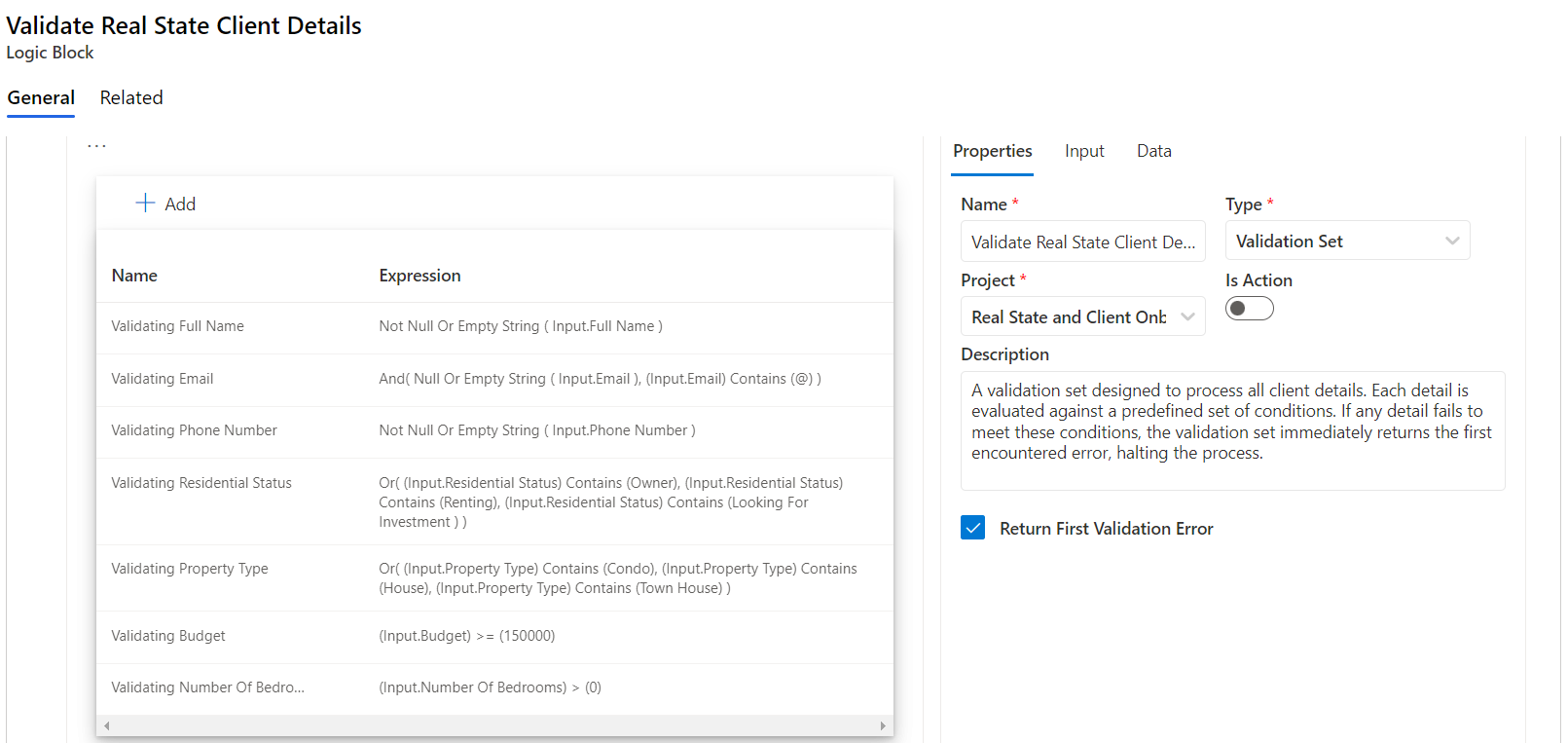

Step 3: Creating a Decision Table to determine the match score, based on the property type, location and budget

As we progress in our endeavor to find the most suitable property for our esteemed real estate clients, a crucial step is to gauge the compatibility of their preferences with the current market trends. To facilitate this alignment, we've crafted a decision table. This table offers a systematic approach to compute the match score based on the property type, budget, and location preferences of the client.

In the above decision table, we can observe the following:

- In the first row, we observe that when a client's preferences lean towards a condo, and they have a budget of $250k or more, with a keen interest in a downtown location, they are awarded a match score of 'A'.

- Moving on to the second row, a client with a penchant for houses and a budget that's greater than or equal to $450k, combined with a preference for suburban locales, will receive a match score of 'B'.

- Lastly, in the third row, a potential client looking for a townhouse and can allocate a budget of $150k or above, who also favors locations near schools, is designated a match score of 'C'.

Step 4: Creating a Decision Table to recommend a loan based on the budget and the matched property

As we continue our comprehensive approach to align potential buyers with their ideal properties, understanding financial feasibility becomes paramount. Recognizing the gap between a client's budget and the price of their matched property can help in tailoring the right financial solution. To streamline this, we've devised a decision table. This table systematically aids in recommending an appropriate loan term based on both the client's budget and the price of the matched property.

In the above decision table, we can observe the following:

- In the first row, when a client has a budget of $350k and is matched with a condo priced at $375k, they face a shortfall of $25k. This financial gap prompts a loan recommendation of a 5-year term.

- Progressing to the second row, a client with a budget of $600k who gets matched with a house priced at $650k encounters a $50k deficit. Given this financial discrepancy, a 10-year term loan is recommended.

- Finally, in the third row, a client willing to allocate a budget of $150k, but gets paired with a townhouse having a price tag of $220k, witnesses a substantial shortfall of $70k. For this considerable difference, a loan recommendation of a 12-year term is made.

Step 5: Creating a Decision Table to Determine the Final Property and Loan Requirements

Finding the right property in the real estate market means balancing what clients want with what they can afford. In Step 5, we've made a Decision Table to help with this. It links previous match scores with property suggestions and loan options, making the path from wanting a home to owning one clearer and easier.

From the table, we can deduce the following insights:

- Clients with a match score of 'A', facing a shortfall of $25k, are aptly matched to a Premium Downtown Condo. To bridge the financial gap,a 5-year loan term is suggested.

- For those scoring a 'B', encountering a $50k discrepancy, an Elegant Suburban House is recommended. A 10-year term loan serves as the proposed financial solution.

- Lastly, clients with a 'C' score, who are $70k shy of their budget, are paired with a Cozy Townhouse. Recognizing the financial needs, a 12-year loan term is the chosen recommendation.

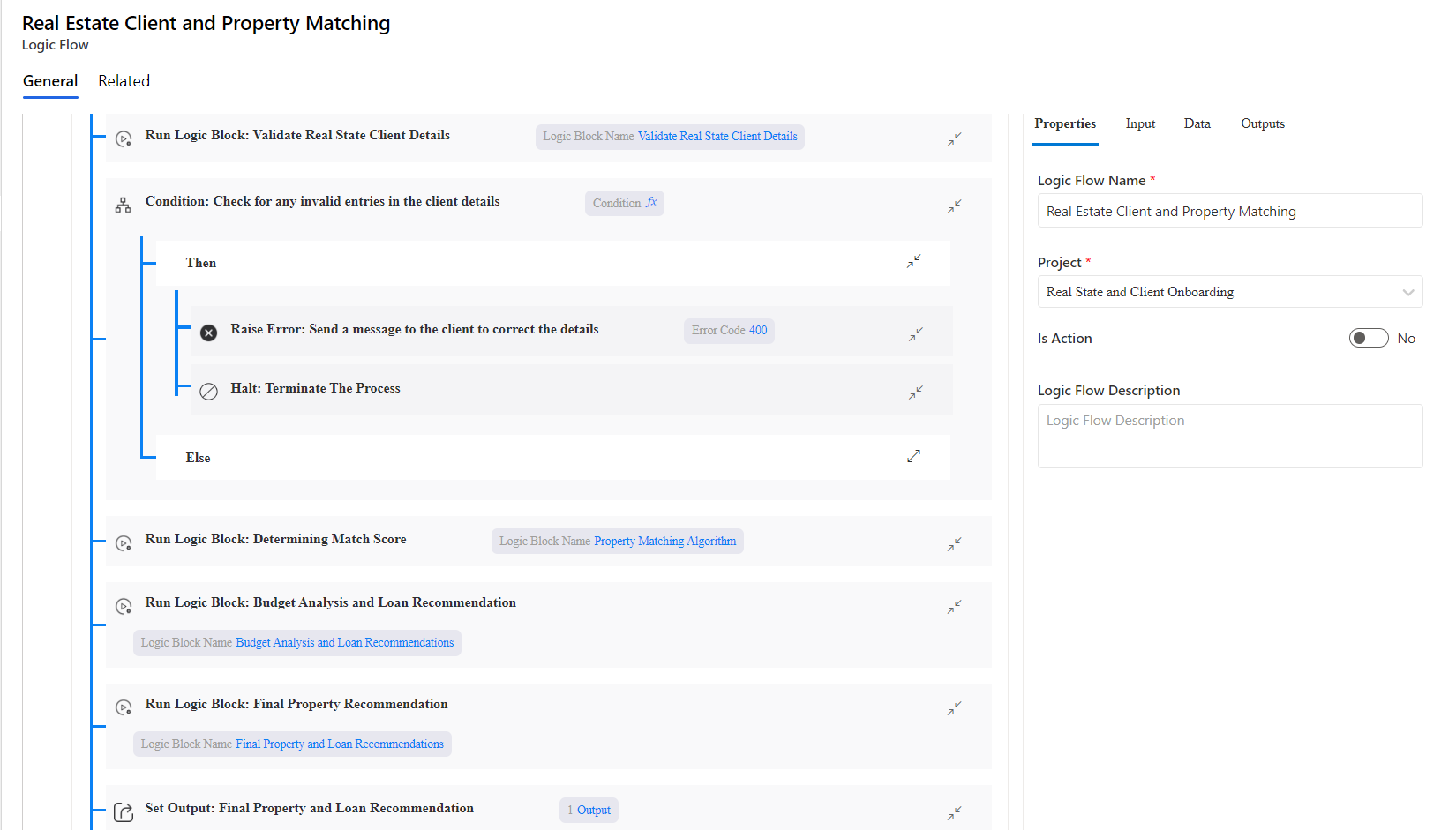

Step 6: Connecting the Dots - Real Estate and Client Matching Flow

Flows logic operates as meticulously arranged sequences, underscoring the deliberate progression of tasks in a specified order. Central to this approach are the individual stages, each crucial in directing the process toward the intended result. In the context of matching real estate options with client preferences, each step guarantees precise data management and a systematic evaluation of client needs and market availability, culminating in an optimized property match for every client.

Following the flow in the picture above, here’s the step-by-step breakdown:

Gathering and Validating Client Information: We start by collecting details about what the client wants in a property. Each detail is checked to make sure it's correct. If something doesn't look right, an error pops up, so we know the information is good to go.

Determining Match Score: Next, we look at what the client wants and see how it lines up with properties out there. Based on this, we give a match score. This helps us know how close a property is to what the client wants.

Budget Analysis and Loan Recommendation: Now, we look at the client's budget and the cost of their dream property. If there's a gap, we suggest a loan that might help cover it, making sure it's something they can afford.

Determining Required Loan: In this step, we figure out the exact loan amount the client might need. We look at the difference between their budget and the property price to get this number.

Determine the Final Property and Loan Requirements: Here, we bring everything together. Using the match score, budget info, and loan details, we come up with a final property and loan recommendation that suits the client.

Presenting the Final Property and Loan Proposition: Finally, we show the client our recommendation. This includes details about the property and how they can finance it. It's a clear guide to help them make their next move.

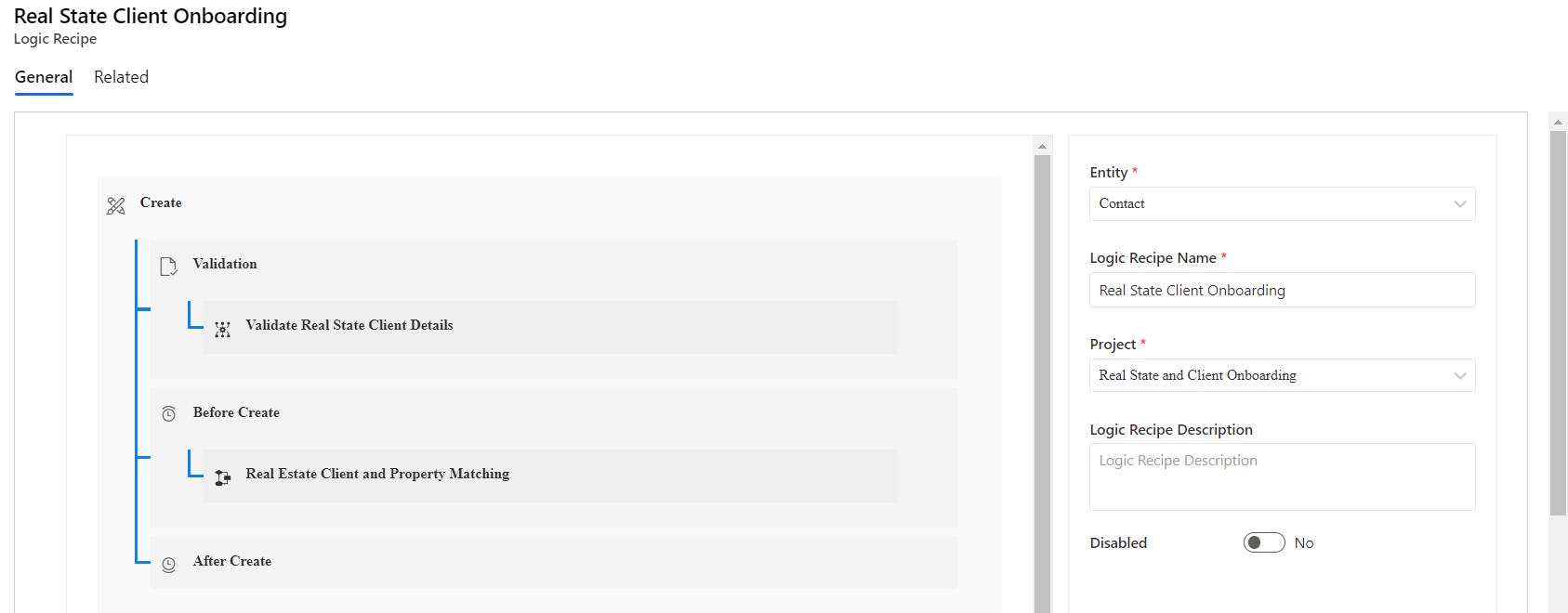

Step 7: Completing the Onboarding and Recording Client Data into the CRM

Consider "Logic Recipes" as our roadmap for executing tasks in a set order. They're like a playbook, guiding us on what steps to take and when, especially when dealing with data — be it when we're adding new data, updating it, or removing it.

In our process, we're focused on the 'create' stage (which includes steps like 'Create' for ensuring data looks right, and 'Before-Create' for actions needed just before we save data). So, for our client details, we'll first double-check everything to make sure it's accurate. Once that's done and all looks good, we'll safely store these details in our CRM.